Back to Journals » Risk Management and Healthcare Policy » Volume 17

Regulated Pricing Decisions and Diagnostic Test Choices in Personalized Medicine: Navigating the Implications Within Legal Frameworks

Authors Cui Z, Liu X, Feng Z , Huang Z

Received 26 June 2024

Accepted for publication 4 November 2024

Published 9 November 2024 Volume 2024:17 Pages 2763—2776

DOI https://doi.org/10.2147/RMHP.S475929

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Gulsum Kubra Kaya

Zibin Cui,1,* Xiangdong Liu,2,* Zehua Feng,3 Zhengzong Huang4

1School of Management, Guangdong University of Technology, Guangzhou, People’s Republic of China; 2Faculty of Humanities and Social Sciences, Macao Polytechnic University, Macao, People’s Republic of China; 3School of Law, Guangdong University of Technology, Guangzhou, People’s Republic of China; 4College of Humanities and Social Science, Shenzhen Technology University, Shenzhen, People’s Republic of China

*These authors contributed equally to this work

Correspondence: Zehua Feng; Zhengzong Huang, Email [email protected]; [email protected]

Background: The emerging risk of personalized medicine is driving drug manufacturers to seek collaborations with advanced diagnostic firms, aiming to improve detection and treatment outcomes. However, the government’s regulated pricing in personalized medicine affects manufacturers’ strategic decisions, particularly regarding the selection of diagnostic partners. In this context, this study investigates whether the government should regulate the price of personalized medicine and how the government’s regulated pricing decisions affect drug manufacturers’ diagnostic test choices.

Methods: A stylized analytical model was developed, employing game-theoretic analysis. Numerical studies are also conducted to validate our results.

Results: The study reveals that in the absence of the government’s regulated pricing, drug manufacturers benefit from partnering with high-level diagnostic firms, enhancing consumer surplus and social welfare. However, when the government regulates pricing, the choice of partnering with a high-level diagnostic firm depends on specific conditions, such as low patient sensitivity to treatment failure and a low unit cost coefficient of diagnostic effort. The government’s decision to regulate prices is influenced by three key parameters: patients’ sensitivity to treatment failure, the unit cost coefficient of the diagnostic test effort, and the proportion of the price of specialized drugs in the regulated pricing.

Conclusions: The findings underscore the importance of legal frameworks in the personalized medicine industry. The absence of the government’s regulated pricing incentivizes collaborations with high-level diagnostic firms, enhancing consumer surplus and social welfare. However, government intervention in pricing makes such decisions contingent on specific conditions, requiring nuanced regulatory policies that balance the interests of patients, manufacturers, and diagnostic firms.

Keywords: personalized medicine, partnership, government, regulated pricing, game theory

Introduction

The evolution of medical treatment has witnessed a significant shift from traditional methods to the more tailored approach of personalized medicine. Traditional medicine, while beneficial, often employs a “one-size-fits-all” approach, particularly evident in the treatment of diseases like lung cancer.1 Unfortunately, this methodology does not account for individual genetic differences, leading to ineffective treatment for a significant proportion of patients. For instance, only about a quarter of cancer patients respond to these generic treatments due to the lack of consideration for their unique genetic makeup.2,3 The advent of personalized medicine, heralded by the decoding of the human genome, has revolutionized this landscape. This approach leverages a patient’s genetic profile to categorize them into specific subpopulations, thereby guiding more precise medical practices, drug selections, dosages, and timing. Such customization ensures that patients receive drugs that are highly effective for their specific condition.4,5 As a result, personalized medicine has demonstrated significant advantages over traditional methods, notably in enhancing patient survival rates and improving the overall quality of life.6 Furthermore, personalized medicine has been shown to be more effective and efficient than traditional medicine. In 2018, personalized medicine accounted for 42% of all new drugs approved by the US Food and Drug Administration (FDA), indicating its rapidly growing importance in healthcare.7,8 Also, recent statistics indicate that the global personalized medicine market was valued at USD 529.28 billion in 2023 and is projected to grow at a CAGR of 8.20% from 2024 to 2030. Unlike the traditional approach, which often relies on non-personalized “blockbuster” drugs designed for the average patient, personalized medicine is based on diagnosing specific biomarkers to predict an individual’s reaction to a particular drug. This method not only increases efficiency but also reduces the risk of adverse side effects that are often associated with the “one-size-fits-all” approach.9,10

The paradigm of personalized medicine necessitates a synergistic collaboration between specialized drug manufacturers and diagnostic firms. This partnership is essential for developing tailored treatments, as the drug manufacturer focuses on creating drugs targeting specific biomarkers, while the diagnostic firm develops tests to identify these biomarkers in patients.11,12 For instance, the development of targeted cancer therapies often involves identifying genetic mutations specific to certain cancer types, and then partnering with diagnostic firms to create tests that detect these mutations in patients. A notable example is the development of targeted therapies for HER2-positive breast cancer, where drug manufacturers have collaborated with diagnostic firms to create tests identifying patients who would benefit from these specialized treatments.13,14 Additionally, personalized medicine is also making strides in other areas, such as type 2 diabetes and Parkinson’s disease, where tailored treatments are being developed based on individual genetic profiles. This cooperative approach ensures that patients receive the most effective treatment for their specific condition, demonstrating the practical application of personalized medicine. This partnership model also streamlines the regulatory approval process, as drug efficacy can be more clearly demonstrated when paired with effective diagnostic tests, expediting the delivery of these innovative treatments to the market.

Despite the advantages of personalized medicine, the rise in adverse events associated with these drugs has led to an increase in both mortality and healthcare costs in recent years.15 As highlighted by McKinsey & Company, this emerging risk is a growing concern in the sector. In response, drug manufacturers are increasingly motivated to partner with high-level diagnostic firms. Such strategic alliances aim to improve detection solutions, thereby mitigating the risks associated with personalized medications. This approach enhances treatment efficacy and safety, bolstering consumer confidence in personalized medicine. MDI Health, a leader in high-level diagnostics, exemplifies this trend, having secured significant investments to expand its diagnostic capabilities. However, choosing a high-level diagnostic partner comes with increased costs. Drug manufacturers collaborating with these advanced firms incur higher expenses than those partnering with lower-tier diagnostic companies. Moreover, personalized medicine’s need for thorough risk analysis for each patient adds to the financial burden for drug manufacturers. This increase in costs and its implications for the industry are discussed in the context of personalized medicine’s market dynamics and investment costs.16 Given the aforementioned circumstances, the strategic decision regarding the choice of diagnostic firms to partner with is pivotal for drug manufacturers. They must consider the technological capabilities and cost structures of these diagnostic firms, as inefficiencies in these areas can significantly affect the feasibility of developing diagnostic tests. This leads us to the pertinent research question of this study: What is the drug manufacturer’s optimal diagnostic test choices, ie, whether the drug manufacturer should partner with the low-level or high-level diagnostic firm considering the risks and costs of personalized medicine? This question is central to understanding the balance between risk management and cost efficiency in the domain of personalized medicine.

Moreover, in numerous countries, the pricing of drugs and diagnostic tests in personalized medicine is under government regulation. For instance, in the United Kingdom, the cost of branded health service medicines is controlled through statutory schemes and agreements like the Branded Health Service Medicines (Costs) Regulations 2018 and the 2019 voluntary scheme for branded medicines pricing and access (VPAS). These schemes, aimed at controlling costs for the NHS, highlight the government’s role in pricing regulation within the healthcare sector. In contrast, markets like the United States allow pharmaceutical companies to set drug prices freely, leading to higher drug costs and sparking debate over pricing policies. Legal frameworks like these influence not only pricing decisions but also how accessible personalized medicines become, potentially affecting patient access and equity. The governmental regulation of prices in personalized medicine has significant implications for drug manufacturers, particularly in terms of revenue management. It directly influences their decision-making process regarding diagnostic test choices. For example, regulatory constraints in Europe might encourage manufacturers to partner with lower-tier diagnostic firms to maintain profitability, while in less regulated environments, they may opt for higher-level diagnostics to improve efficacy. However, the extent to which government pricing regulation affects the choice of a suitable diagnostic firm by drug manufacturers remains an uncharted territory. Additionally, the impact of such regulatory practices on overall social welfare and whether they hinder drug manufacturers from opting for high-level diagnostic tests is unclear. To bridge this gap, our study aims to develop analytical models for a comprehensive investigation of these aspects. The primary research questions guiding our research are: What is the drug manufacturer’s diagnostic test choices without and with the government’s regulated pricing? Should the government regulate the price of personalized medicine considering the drug manufacturer’s diagnostic test choice?

Previous research on personalized medicine has explored the revenue-sharing and cost-sharing contracts of pharmaceutical and diagnostic firms under regulated or free pharmaceutical pricing,17 as well as the strategic decisions pharmaceutical firms make in choosing diagnostic firms for collaboration.18 However, to the best of our knowledge, the interplay between the government’s regulated pricing decisions and the drug manufacturer’s diagnostic test choices in personalized medicine has not been thoroughly investigated. This study endeavors to fill this critical gap in the literature.

To address the above research questions, we formally develop a stylized analytical model and conduct a Stackelberg game-theoretic analysis. Specifically, we consider a personalized medicine market with a drug manufacturer, a low-level or a high-level diagnostic firm, and a government. The treatment of personalized medicine requires specialized drugs from the drug manufacturer and diagnostic tests from the diagnostic firm. The government decides whether to regulate the price of personalized medicine or not and the drug manufacturer chooses to partner with the low-level or high-level diagnostic firm. When the government decides not to regulate pricing, the drug manufacturer sets the price of specialized drugs and the diagnostic firm sets the price of diagnostic tests sequentially. When the government decides to regulate pricing, the government sets the price of personalized medicine, which consists of the price of specialized drugs and diagnostic tests.

Model Description

We consider a personalized medicine market with a monopolistic drug manufacturer M, which partners with a low-level diagnostic firm LD or a high-level diagnostic firm HD.19 Patients purchase personalized medicine at a price that consists of the price of specialized drugs and the price of diagnostic tests, and the government may regulate this price. The decision that the government decides not to or decides to regulate pricing is denoted by N and R. L and H respectively represent that the drug manufacturer chooses to partner with the low-level or high-level diagnostic firm. The personalized medicine market is shown in Figure 1 and Table 1 shows the notations used in this study. There are some basic assumptions in this study, which are as follows.

- The level of diagnostic test effort of the low-level diagnostic firm is dL and that of the high-level diagnostic firm is dH, where dL<dH. A higher level of diagnostic test effort means lower personalized medicine treatment failure probability. For ease of analysis, we assume dL=0 and dH=d (0 <d<1) without loss of generality.

- The drug manufacturer needs to pay for partnering with the diagnostic firm that provides reliable drug management. Since diagnostic tests require a comprehensive risk analysis, recommendation, and report on the effectiveness of the specialized drug in treating each patient, the cost of diagnostic tests increases with higher demand for personalized medicine. Therefore, the unit fee paid by the drug manufacturer to the diagnostic firm is αd, which is related to the level of diagnostic test effort.

- Assume that patients are risk-averse and their willingness-to-pay (WTP) for personalized medicine v is heterogeneous and uniformly distributed in the interval [0,1].

- As describe in Lütkemeyer et al,17 the government is the Stackelberg leader and the drug manufacturer is follower in the market. After the government makes the regulated pricing decisions, the drug manufacturer makes the diagnostic test choices.

|

Table 1 Summary of Notations |

|

Figure 1 The personalized medicine market. |

In practice, the treatment of personalized medicine may result in specialized drug-related risks. Following Bhattacharya et al,20 we denote the personalized medicine treatment failure probability without diagnostic test as φ, while the treatment success probability as 1-φ, which are known to firms and patients based on industry experience. The drug manufacturer chooses low-level or high-level diagnostic firms when selling personalized medicine to patients. If the drug manufacturer chooses the low-level diagnostic firm, the personalized medicine treatment failure probability is reduced to (1-dL)φ. Accordingly, the personalized medicine treatment failure probability is reduced to (1-dH)φ if the drug manufacturer chooses the high-level diagnostic firm.

As mentioned in Section 1, the prices of personalized medicine may be regulated by the government. When the government decides not to regulate the prices, the drug manufacturer and the diagnostic firm can freely set the prices to maximize their profits. In this case, the drug manufacturer decides the price of specialized drugs PM. first and the diagnostic firm decides the price of diagnostic tests  later.18 When the government decides to regulate the prices, the government will set the total price of specialized drugs and diagnostic tests to maximize social welfare. We denote the total price decided by the government as p and pM=rp, PiD=(1-r)p, where r is the proportion of the price of specialized drugs in regulated pricing.

later.18 When the government decides to regulate the prices, the government will set the total price of specialized drugs and diagnostic tests to maximize social welfare. We denote the total price decided by the government as p and pM=rp, PiD=(1-r)p, where r is the proportion of the price of specialized drugs in regulated pricing.

When patients decide whether to purchase personalized medicine, they will consider the probability of personalized medicine treatment failure. We denote the negative effect of the treatment failure probability on patients’ utilities as  , where

, where  is patients’ sensitivity to treatment failure in personalized medicine. Since the personalized medicine treatment failure probability is reduced to (1-d)φ. In the case that the drug manufacturer chooses to partner with the high-level diagnostic firm, the negative effect of the treatment failure probability on patients’ utilities becomes (1-d)φ. Also, patients will consider the price of personalized medicine, which is combined with the price of specialized drugs and the price of diagnostic tests. Therefore, when patients make purchasing decisions in the case that the drug manufacturer chooses to partner with the low-level diagnostic firm, their utilities (

is patients’ sensitivity to treatment failure in personalized medicine. Since the personalized medicine treatment failure probability is reduced to (1-d)φ. In the case that the drug manufacturer chooses to partner with the high-level diagnostic firm, the negative effect of the treatment failure probability on patients’ utilities becomes (1-d)φ. Also, patients will consider the price of personalized medicine, which is combined with the price of specialized drugs and the price of diagnostic tests. Therefore, when patients make purchasing decisions in the case that the drug manufacturer chooses to partner with the low-level diagnostic firm, their utilities ( ) are

) are

Similarly, when patients make purchasing decisions in the case that the drug manufacturer chooses to partner with the high-level diagnostic firm, their utilities ( ) are

) are

Based on patients’ utilities, the demand for personalized medicine when the drug manufacturer chooses to partner with the low and high-level diagnostic firm are  and

and  , respectively. Since the success rate of personalized medicine treatment is 1-φ when the drug manufacturer partners with a low-level diagnostic firm, both the drug manufacturer and the diagnostic firm earn profits of PMq and pLDq, respectively, with probability 1-φ. Conversely, if the treatment fails, neither the drug manufacturer nor the diagnostic firm can generate any profit, occurring with probability. Therefore, the expected profit of the drug manufacturer is

, respectively. Since the success rate of personalized medicine treatment is 1-φ when the drug manufacturer partners with a low-level diagnostic firm, both the drug manufacturer and the diagnostic firm earn profits of PMq and pLDq, respectively, with probability 1-φ. Conversely, if the treatment fails, neither the drug manufacturer nor the diagnostic firm can generate any profit, occurring with probability. Therefore, the expected profit of the drug manufacturer is  , and the expected profit of the low-level diagnostic firm is

, and the expected profit of the low-level diagnostic firm is  . The expected profits of the drug manufacturer and the low-level diagnostic firm, patients’ consumer surplus and social welfare in this case (

. The expected profits of the drug manufacturer and the low-level diagnostic firm, patients’ consumer surplus and social welfare in this case ( ) are

) are

Similarly, with the probability of personalized medicine treatment success 1-((1-d)φ) when the drug manufacturer chooses to partner with the high-level diagnostic firm, the expected profits of the drug manufacturer and the high-level diagnostic firm, patients’ consumer surplus and social welfare in this case ( ) are

) are

We study a three-stage game without information asymmetry between the firms and the government. Following Lütkemeyer et al,17 we set the time sequence of the game, as shown in Figure 2. In the first stage, the government decides whether to regulate the price of personalized medicine or not. In the second stage, the drug manufacturer chooses the low-level or high-level diagnostic firm to partner with. In the third stage, if the government decides not to regulate pricing, the drug manufacturer sets the price of specialized drugs first and the diagnostic firm sets the price of diagnostic tests later; if the government decides to regulate pricing, the government sets the total price of specialized drugs and diagnostic tests.

|

Figure 2 The sequence of the game. |

Discussion

In this section, we explore the equilibrium outcomes in each case considering the government’s regulated pricing decisions and the drug manufacturer’s diagnostic test choices. The proofs of analysis are all in the Supplementary Appendix.

No regulated pricing

We first investigate the case that the government decides not to regulate pricing and the drug manufacturer chooses to partner with the low-level diagnostic firm. We solve this game by backward induction. By maximizing the drug manufacturer and the low-level diagnostic firm’s profits, Proposition 1 presents the optimal price of specialized drugs and diagnostic tests set by the drug manufacturer and the diagnostic firm.

In this case, to guarantee positive demand and prices, and guarantee that the drug manufacturer’s and the diagnostic firm’s profits are concave in the decision variables, we assume that  .

.

Next, we investigate the case in which the government decides not to regulate pricing and the drug manufacturer chooses to partner with the high-level diagnostic firm. Proposition 2 presents the optimal price of specialized drugs and diagnostic tests set by the drug manufacturer and the diagnostic firm.

In this case, to guarantee positive demand and prices and guarantee that the drug manufacturer’s and the diagnostic firm’s profits are concave in the decision variables, we assume that  and

and  .

.

We here compare the equilibrium outcomes of the drug manufacturer partnering with the low-level diagnostic firm with the outcomes of partnering with the high-level diagnostic firm. We aim to explore how the drug manufacturer’s diagnostic test choices affects the equilibrium outcomes. Theorem 1 presents the impact of the drug manufacturer’s diagnostic test choices on the price of specialized drugs and the demand for personalized medicine.

Theorem 1 shows that if the government decides not to regulate pricing, the drug manufacturer partnering with the high-level diagnostic firm results in a higher optimal price of specialized drugs and the demand for personalized medicine compared to partnering with the low-level diagnostic firm. This outcome is attributed to the pivotal role of diagnostic test efforts in mitigating personalized medicine treatment failure probabilities. Opting for a high-level diagnostic firm, characterized by a more comprehensive risk analysis, enhances treatment success probabilities, thereby reducing the perceived risks for risk-averse patients. Consequently, patients are more inclined to purchase personalized medicine, driving demand. Management implications stem from the insight that drug manufacturers should strategically align with high-level diagnostic companies to optimize prices and foster demand in an unregulated pricing scenario. This underscores the significance of investing in advanced diagnostic capabilities for drug manufacturers and encourages collaboration between stakeholders to collectively enhance the value proposition of personalized medicine in the absence of government intervention.

Based on the above analysis of prices and demand, we next examine how the drug manufacturer’s diagnostic test choices affects the drug manufacturer’s profit, consumer surplus, and social welfare.

Our study’s finding under Theorem 2 (i) highlights a critical aspect of the pharmaceutical industry’s strategic decision-making in the context of personalized medicine. Notably, we discover that, in the absence of the government’s regulated pricing, the drug manufacturer’s collaboration with the high-level diagnostic firm is invariably more profitable than partnering with the low-level diagnostic firm. The result indicates that the drug manufacturer should choose to partner with the high-level diagnostic firm without the government’s regulated pricing. This advantage persists even when considering the potentially higher costs associated with such a partnership. The underlying reason for this phenomenon lies in the greater autonomy in pricing specialized drugs that the drug manufacturer enjoys without government intervention. This pricing flexibility allows for more effective revenue management, thereby compensating for the higher costs of partnering with the high-level diagnostic firm. These findings have profound implications for drug manufacturers, suggesting a strategic shift towards collaborations with high-level diagnostic firms to maximize profits in an unregulated market. This strategy not only aligns with the financial goals of the drug manufacturers but also potentially enhances the quality and effectiveness of personalized medicine, fostering a more robust healthcare ecosystem.

Further, Theorem 2 (ii) and (iii) reveal that the drug manufacturer partnering with the high-level diagnostic firm without the government’s regulated pricing generates higher consumer surplus and social welfare compared to partnering with the low-level diagnostic firm. This outcome is primarily attributed to the ability of high-level diagnostic tests to significantly reduce the personalized medicine treatment failure probability, thereby enhancing patient outcomes and satisfaction. Consequently, the heightened consumer surplus denotes the substantial benefit accruing to patients, who are inherently risk-averse in their decision-making. Simultaneously, the broader societal gains, encapsulated by social welfare, underscore the positive impact of improved patient outcomes on the government. This insight holds critical implications for management decisions, signaling that prioritizing partnerships with high-level diagnostic firms aligns not only with enhanced patient well-being but also with maximizing societal welfare. Moreover, this underscores the importance of policy considerations, as the government’s regulated pricing may inadvertently impede the optimization of patient and societal benefits in the personalized medicine landscape. As diagnostic tests play a pivotal role in mitigating specialized drug-related risks, their integration at a high level warrants strategic attention, both from a healthcare management perspective and a policy standpoint.

To clearly illustrate our findings in the above theorems, we numerically analyze the effect of the drug manufacturer’s diagnostic test choices on the price of specialized drugs, the demand for personalized medicine, the drug manufacturer’s profit, consumer surplus, and social welfare by assuming φ=0.3, and d=0.5 α=0.3. The variable difference is used to describe the comparison of the two cases. We denote  ,

,  ,

,  ,

,  , and

, and  . Figure 3 shows the trends of the variable differences with respect to patients’ sensitivity to treatment failure in personalized medicine.

. Figure 3 shows the trends of the variable differences with respect to patients’ sensitivity to treatment failure in personalized medicine.

|

Regulated pricing

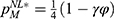

We then study the case in which the government decides to regulate pricing and the drug manufacturer chooses to partner with the low-level diagnostic firm. By maximizing social welfare, Proposition 3 shows the optimal price of specialized drugs and diagnostic tests set in line with a proportion by the government.

In this case, to guarantee positive demand and prices and guarantee that social welfare is concave in the decision variables, we assume that  and

and  .

.

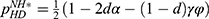

We finally study the case in which the government decides to regulate pricing and the drug manufacturer chooses to partner with the high-level diagnostic firm. By maximizing social welfare, Proposition 4 shows the optimal price of specialized drugs and diagnostic tests set in line with a proportion by the government.

Proposition 4. In Case RH, we have  and

and

In this case, to guarantee positive demand and prices and guarantee that social welfare is concave in the decision variables, we assume that  and.

and.

We here compare the equilibrium outcomes of the drug manufacturer partnering with the low-level diagnostic firm with the outcomes of partnering with the high-level diagnostic firm according to the above results. We aim to explore how the drug manufacturer’s diagnostic test choices affect the equilibrium outcomes with the government’s regulated pricing. Theorem 3 analyzes the impact of the drug manufacturer’s diagnostic test choices on the price of specialized drugs and the demand for personalized medicine.

Theorem 3 (i) shows that with the government’s regulated pricing, the drug manufacturer partnering with the high-level diagnostic firm generates a higher optimal price of specialized drugs compared to partnering with the low-level diagnostic firm, only if patients’ sensitivity to treatment failure in personalized medicine is sufficiently low; otherwise, it generates a lower price. This finding reveals that the government’s regulated pricing decisions affect the optimal price of specialized drugs differently depending on the level of diagnostic test effort and patients’ sensitivity to treatment failure in personalized medicine. When patients are less sensitive to treatment failure, partnering with the high-level diagnostic firm reduces the perceived risk of personalized medicine, thereby increasing patients’ willingness to pay and allowing the drug manufacturer to charge a higher price. However, when patients are more sensitive to treatment failure, partnering with the high-level diagnostic firm increases the cost of diagnostic tests, which outweighs the benefit of lower treatment failure probability and forces the drug manufacturer to lower the price to maintain demand. This finding implies that the government should consider the trade-off between diagnostic test effort and treatment failure probability when setting the regulated price of personalized medicine and also take into account the heterogeneity of patients’ risk preferences and valuations.

Also, Theorem 3 (ii) shows that with the government’s regulated pricing, the drug manufacturer partnering with the high-level diagnostic firm generates a higher demand for personalized medicine compared to partnering with the low-level diagnostic firm, only if patients’ sensitivity to treatment failure in personalized medicine is sufficiently high; otherwise, it generates a lower demand. This finding underscores the pivotal role of diagnostic firm selection in influencing patient demand, particularly in scenarios where treatment outcomes are of paramount concern. The heightened demand when aligned with a high-level diagnostic firm can be attributed to the associated reduction in personalized medicine treatment failure probability, a consequence of the rigorous diagnostic efforts. This insight carries substantial managerial implications, suggesting that drug manufacturers, in their strategic collaborations, should consider not only the cost implications but also the impact on patient demand, especially in a regulated pricing environment. Policymakers, too, are urged to acknowledge the intricate interplay between patient preferences and diagnostic strategies when formulating regulatory frameworks, as these factors critically shape the dynamics of demand in the personalized medicine landscape.

Based on the above results, we next examine how the drug manufacturer’s diagnostic test choices affect the drug manufacturer’s profit, consumer surplus, and social welfare with the government’s regulated pricing.

Theorem 4. (i)  and

and  otherwise,

otherwise,  (ii)

(ii)  otherwise,

otherwise,  (iii)

(iii)  otherwise,

otherwise,

Theorem 4 (i) reveals that if the government decides to regulate pricing, the drug manufacturer always earns a higher profit when partnering with the high-level diagnostic firm compared to partnering with the low-level diagnostic firm only if patients’ sensitivity to treatment failure in personalized medicine and the unit cost coefficient of the diagnostic test effort are sufficiently low; otherwise, the drug manufacturer earns a lower profit. In our analysis of the drug manufacturer’s diagnostic test choices, we discerned a nuanced interplay between governmental regulation, diagnostic firm selection, and profit optimization for the drug manufacturer. This finding, particularly under the government’s regulated pricing, highlights the complex dynamics between market forces and regulatory interventions. When the government regulates prices to promote social welfare, a high-level diagnostic firm partnership becomes more profitable for the drug manufacturer, but only under certain conditions: notably when patients exhibit low sensitivity to treatment failure and when the cost coefficient of diagnostic test efforts remains sufficiently low. However, in cases where these conditions are not met, regulated pricing may reduce the incentive for manufacturers to invest in high-level partnerships, potentially hindering the efficiency of personalized medicine development. This outcome suggests a threshold effect in the strategic alliance between drug manufacturers and diagnostic firms. From a managerial perspective, this implies that drug manufacturers must carefully evaluate not only the capability of diagnostic firms but also the cost dynamics and patient perceptions regarding treatment efficacy. It underscores the need for a more holistic approach in decision-making, taking into account the interdependencies between patient attitudes, regulatory landscapes, and partnership strategies. For policymakers, the findings advocate for a balanced approach in price regulation, one that considers the unintended consequences on innovation and partnership dynamics in the healthcare sector. Such insights contribute to the broader discourse on the optimal design of healthcare systems, particularly in the burgeoning field of personalized medicine, where the alignment of economic incentives, patient welfare, and technological advancement remains a critical, yet challenging, endeavor.

Further, Theorem 4 (ii) and (iii) discuss the effects of the drug manufacturer’s diagnostic test choices on consumer surplus and social welfare in the government’s regulated pricing environment for personalized medicine. According to Theorem 4 (ii), consumer surplus is lower when partnering with the low-level diagnostic firm compared to the high-level firm if patients’ sensitivity to treatment failure is high, and vice versa. This finding suggests that high-level diagnostic partnerships can enhance consumer value, particularly when patients are highly sensitive to treatment outcomes. Theorem 4 (iii) follows a similar pattern for social welfare: it is lower with low-level diagnostic firm partnerships if patients’ sensitivity to treatment failure is high. This result implies that the choice of diagnostic firm has significant implications for overall societal health outcomes, especially in contexts where patient sensitivity to treatment failure is a major concern. These insights underline the importance of strategic diagnostic firm selection in the personalized medicine market, particularly under the government’s regulated pricing. For drug manufacturers, this means balancing the cost of partnering with higher-level diagnostic firms against the potential benefits in terms of increased consumer surplus and social welfare. From a policy perspective, these findings suggest that regulations should account for the nuanced effects of diagnostic test accuracy and patient sensitivity to treatment outcomes on the market dynamics of personalized medicine. Such considerations are vital for optimizing patient and societal benefits in the healthcare sector.

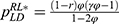

To clearly illustrate our findings in the above theorems, we numerically analyze the effect of the drug manufacturer’s diagnostic test choices on the price of specialized drugs, the demand for personalized medicine, the drug manufacturer’s profit, consumer surplus, and social welfare by assuming φ=0.3, d=0.5, α=0.3, and r=0.7. The variable difference is used to describe the comparison of the two cases. We denote.  ,

,  ,

,  ,

,  , and

, and  Figure 4 shows the trends of the variable differences with respect to patients’ sensitivity to treatment failure in personalized medicine.

Figure 4 shows the trends of the variable differences with respect to patients’ sensitivity to treatment failure in personalized medicine.

|

Government’s regulated pricing decision

This section delves into the critical analysis of whether the government should regulate pricing in the realm of personalized drugs. We willexamine the consequences of such a decision on market dynamics, healthcare accessibility, and innovation in personalized medicine. The discussion emphasizes the need to balance economic feasibility for producers with affordability for consumers, highlighting the importance of government intervention in shaping a sustainable and equitable healthcare landscape. The significance of this analysis is underscored by the growing prominence of personalized medicine and its potential impact on future healthcare policies. We use backward induction to derive the government’s regulated pricing decisions based on the conditions of the drug manufacturer’s diagnostic test choices.

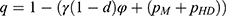

Theorem 5. The government should adopt regulated pricing if and only if  ,

,  and r>r1; otherwise, the government should not adopt regulated pricing.

and r>r1; otherwise, the government should not adopt regulated pricing.

Theorem 5 finds that the government should adopt regulated pricing if and only if patients’ sensitivity to treatment failure in personalized medicine and the unit cost coefficient of the diagnostic test effort are sufficiently low, and the proportion of the price of specialized drugs in regulated pricing is sufficiently high; otherwise, the government should not adopt regulated pricing. The result emphasizes the delicate balance that needs to be maintained in the personalized medicine market. This balance pertains to the economic feasibility for producers and the affordability for consumers, highlighting the role of government intervention in creating a sustainable and equitable healthcare landscape, especially given the increasing importance of personalized medicine. The rationale behind this result is grounded in the dynamics of market forces and the impact of government regulation on these forces. When patients’ sensitivity and the unit cost coefficient are low, it implies that patients are less sensitive to treatment failure, and the costs of diagnostic efforts are manageable. In such a scenario, regulating prices can help in ensuring affordability without significantly compromising the economic incentives for drug manufacturers and diagnostic firms. On the other hand, when patients’ sensitivity is high, patients are more sensitive to treatment failures, and a higher unit cost coefficient indicates a higher cost for diagnostic efforts. Finally, a high proportion of the drug price in the regulated scenario suggests that the government’s intervention primarily affects the drug price rather than diagnostic costs, which could be more acceptable for stakeholders while still managing overall treatment costs effectively. Under these conditions, regulated pricing could potentially lead to reduced innovation and accessibility in the personalized medicine market, as the economic viability for producers might be compromised. Therefore, our finding suggests that in such situations, the government should refrain from regulating prices to maintain a healthy balance between innovation, accessibility, and affordability in the personalized medicine landscape.

The results in Theorem 5 provide important implications for policymakers. The decision to regulate prices is not just an economic calculation but also a strategic one, considering the long-term implications for healthcare accessibility and innovation in personalized medicine. Lower patient sensitivity to treatment failure and lower diagnostic test costs suggest a market environment where producers can sustain profitability while maintaining reasonable prices for consumers, making government intervention through price regulation a viable strategy to ensure affordability. However, if these conditions are not met, regulated pricing may impede market dynamics, potentially stifling innovation and reducing accessibility due to decreased economic incentives for producers. The implications of Theorem 5 are significant in the evolving landscape of personalized medicine, highlighting the need for government policies to be dynamically attuned to market conditions and patient sensitivities to ensure a sustainable and equitable healthcare ecosystem.

Conclusions

In this study, we conducted a detailed investigation into the interplay between the government’s regulated pricing decisions and the drug manufacturer’s diagnostic test choices in the field of personalized medicine. Motivated by the need to balance economic feasibility and healthcare efficacy, our research delved into the pivotal question of whether and how government intervention in pricing could influence the strategic decisions of pharmaceutical companies, particularly in choosing between low-level and high-level diagnostic firms. To systematically analyze these interactions, we developed a stylized analytical model that employed game-theoretic principles, providing a nuanced view of the market forces at play. Our model not only offered insights into the economic implications of these decisions but also shed light on the potential impact on healthcare outcomes and social welfare.

Our study yields several critical findings regarding the interplay between the government’s regulated pricing decisions and drug manufacturers’ diagnostic test choices in the realm of personalized medicine. First, when the government does not regulate the price of personalized medicine, it is advantageous for drug manufacturers to partner with high-level diagnostic firms. This choice consistently enhances consumer surplus and social welfare. Second, in scenarios where the government regulates the price of personalized medicine, the decision of drug manufacturers to partner with a high-level diagnostic firm is contingent upon specific conditions. These include a low sensitivity of patients to treatment failure and a low unit cost coefficient of the diagnostic test effort. Such a partnership is beneficial for consumer surplus and social welfare, especially when patients’ sensitivity to treatment failure is high. Furthermore, it is evident that the government’s regulated pricing weakens the motivation of drug manufacturers to choose high-level diagnostic firms, potentially impeding the efficiency of personalized medicine development. The government’s decision to regulate prices is influenced by three key parameters: patients’ sensitivity to treatment failure, the unit cost coefficient of the diagnostic test effort, and the proportion of the price of specialized drugs in the regulated pricing. The government is more likely to regulate the price of personalized medicine when patients’ sensitivity to treatment failure and the unit cost coefficient of the diagnostic test effort are low, and when the proportion of the price of specialized drugs in regulated pricing is considered. Conversely, the absence of these conditions leads to a non-regulation stance by the government. This nuanced approach to pricing regulation reflects a complex balancing act, seeking to optimize outcomes for all stakeholders in the personalized medicine landscape.

This research underscores the critical role of legal frameworks in shaping the personalized medicine industry. The findings reveal that the absence of the government’s regulated pricing incentivizes drug manufacturers to collaborate with high-level diagnostic firms, leading to enhanced consumer surplus and social welfare. However, when the government intervenes with price regulation, this choice becomes contingent upon specific conditions, such as patient sensitivity to treatment failure and the cost-effectiveness of diagnostic efforts. Legally, these insights suggest the need for nuanced regulatory policies that balance the interests of all stakeholders—patients, manufacturers, and diagnostic firms. Specifically, the government should consider flexible pricing models that incentivize innovation while ensuring affordable access to treatments for patients. Such policies could promote equitable outcomes without stifling advancements in diagnostics or creating undue financial burdens on healthcare systems. From a managerial perspective, these findings emphasize the importance of strategic decision-making in response to varying legal environments. Drug manufacturers must navigate these regulations skillfully, aligning their partnership strategies with the legal context to optimize both economic and healthcare outcomes. Thus, legal considerations are integral to the effective management of personalized medicine, ensuring that regulatory frameworks support innovation while safeguarding patient interests and social welfare.

Our study opens up several avenues for future research. First, while our model provides a nuanced understanding of market dynamics, it simplifies complex real-world interactions, which could be further explored through more comprehensive models incorporating additional variables and scenarios. Future research could expand on this by integrating more real-world complexities and variables, enhancing the model’s applicability and robustness. Second, our focus on game-theoretic principles and economic feasibility might have overlooked certain ethical and policy implications inherent in personalized medicine and healthcare decision-making. Future studies should delve into these aspects, examining the ethical and policy dimensions of government interventions and pricing strategies. Finally, our research points to the critical role of patient preferences and sensitivity in driving government and industry decisions. Future research endeavors could benefit from a deeper exploration of patient-centric approaches, analyzing how varying patient profiles and preferences impact strategic decisions in personalized medicine. This line of inquiry could lead to more patient-focused strategies and policies, ultimately contributing to more effective and equitable healthcare outcomes.

Acknowledgments

This work was supported by Major Research Project on Philosophy and Social Science Research, Ministry of Education of the People’s Republic of China (Grant Number 22JZD017); Shenzhen Science and Technology Planning Project (Grant Number JCYJ20210324135411031); Pingshan District Health System Scientific Research Project (Grant Number 202289); Guangzhou Philosophy and Social Science Development “14th Five-Year Plan” 2024 Annual Project (Grant Number 2024GZYB96); Teaching Reform Project of Shenzhen Technology University (Grant Number 20241046) and 2024 Foshan Social Science Project (Grant Number 2024-GJ090, 2024-GJ166).

Disclosure

The authors report no conflicts of interest in this work.

References

1. Cao Q, Buskens E, Hillege HL, Jaarsma T, Postma M, Postmus D. Stratified treatment recommendation or one-size-fits-all? A health economic insight based on graphical exploration. Eur J Health Econ. 2019;20:475–482.

2. Avó Luís AB D′, Seo MK. Has the development of cancer biomarkers to guide treatment improved health outcomes? Eur J Health Econ. 2021;22:789–810.

3. Tantalo DG, Oliver AJ, von Scheidt B, et al. Understanding T cell phenotype for the design of effective chimeric antigen receptor T cell therapies. J ImmunoTher Canc. 2021;9.

4. Su M, Zhang Z, Zhou L, Han C, Huang C, Nice EC. Proteomics, personalized medicine and cancer. Cancers. 2021;13(2512).

5. Yamamoto Y, Kanayama N, Nakayama Y, Matsushima N. Current status, issues and future prospects of personalized medicine for each disease. J PersonalMed. 2022;12(444).

6. Cai H, Lu W, Marceau West R, Mehrotra DV, Huang L. CAPITAL: optimal subgroup identification via constrained policy tree search. Stat Med. 2022;41:4227–4244.

7. Terkola R, Antoñanzas F, Postma M. Economic evaluation of Personalized Medicine: A Call for Real-World Data. Springer; 2017:1065–1067.

8. Bourret P, Castel P, Bergeron H, Cambrosio A. Organizing precision oncology: introduction to the special issue. New Genetics Socie. 2021;40:1–6.

9. Goričar K, Dolžan V, Lenassi M. Extracellular vesicles: a novel tool facilitating personalized medicine and pharmacogenomics in oncology. Front Pharmacol. 2021;12(671298).

10. Linsley PS, Greenbaum CJ, Nepom GT. Uncovering pathways to personalized therapies in type 1 diabetes. Diabetes. 2021;70:831–841.

11. Mathew R, McGee R, Roche K, Warreth S, Papakostas N. Introducing Mobile Collaborative Robots into Bioprocessing Environments: personalised Drug Manufacturing and Environmental Monitoring. Appl Sci. 2022;12(10895).

12. Diekema DS. Bioethics Co. Health care clinicians and product promotion by industry. Pediatrics. 2022;149:e2022056549.

13. Schlam I, Swain SM. HER2-positive breast cancer and tyrosine kinase inhibitors: the time is now. NPJ Breast Cancer. 2021;7(56).

14. Venetis K, Crimini E, Sajjadi E, et al. HER2 low, ultra-low, and novel complementary biomarkers: expanding the spectrum of HER2 positivity in breast cancer. Front Mol Biosci. 2022;9(834651).

15. Antoñanzas F, Rodríguez-Ibeas R, Juárez-Castelló CA. Personalized medicine and pay for performance: should pharmaceutical firms be fully penalized when treatment fails? Pharmacoeconomics. 2018;36:733–743.

16. Hatz MH, Schremser K, Rogowski WH. Is individualized medicine more cost-effective? A systematic review. Pharmacoeconomics. 2014;32:443–455.

17. Lütkemeyer D, Heese HS, Wuttke DA. Overcoming inefficiencies in the development of personalized medicine. Eur J Oper Res. 2021;290:278–296.

18. Lütkemeyer D, Heese HS, Wuttke DA, Gernert AK. Pricing and market entry decisions in personalized medicine. Int J Prod Econ. 2022;253(108584).

19. Agarwal A, Ressler D, Snyder G. The current and future state of companion diagnostics. Pharmac Person Med. 2015;99–110.

20. Bhattacharya S, Gaba V, Hasija S. A comparison of milestone-based and buyout options contracts for coordinating R&D partnerships. Manage Sci. 2015;61:963–978.

© 2024 The Author(s). This work is published and licensed by Dove Medical Press Limited. The

full terms of this license are available at https://www.dovepress.com/terms.php

and incorporate the Creative Commons Attribution

- Non Commercial (unported, 3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted

without any further permission from Dove Medical Press Limited, provided the work is properly

attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2024 The Author(s). This work is published and licensed by Dove Medical Press Limited. The

full terms of this license are available at https://www.dovepress.com/terms.php

and incorporate the Creative Commons Attribution

- Non Commercial (unported, 3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted

without any further permission from Dove Medical Press Limited, provided the work is properly

attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.